July 1, 2025

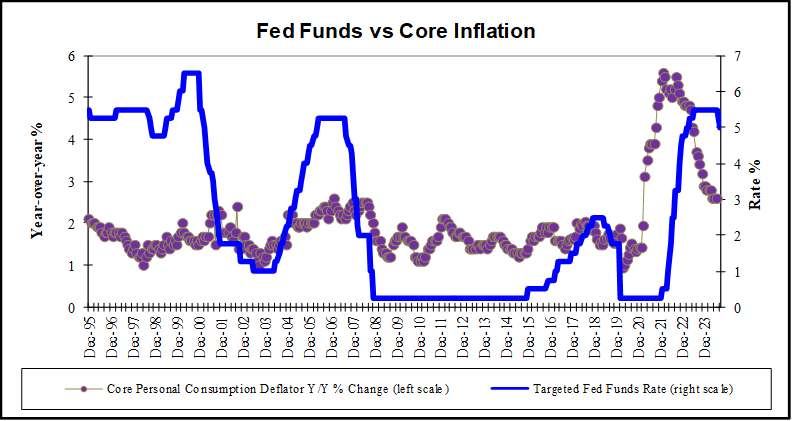

Interest rates remained unchanged following the Federal Open Market Committee (FOMC) meeting on June 17-18. The Federal Reserve officials exercised caution due to uncertainty around trade and fiscal policies and their effect on the economy. The Federal Reserve needs time to assess how those policies impact both sides of its dual mandates of full employment and stable prices. The Committee determined that the risks of both higher unemployment and higher inflation have risen

Geopolitical turmoil, trade, and fiscal policy continue to present elevated uncertainty in the outlook to the FOMC. The updated Summary of Economic Projects (SEP) median projections indicate subdued economic growth for 2025 and 2026, in addition to higher unemployment and inflation. The median levels from the latest “dot plot” maintained the 50 basis points of rate in the second half of 2025, while the cuts for 2026 and 2027 were trimmed back to one cut each year, compared to two shown previously.

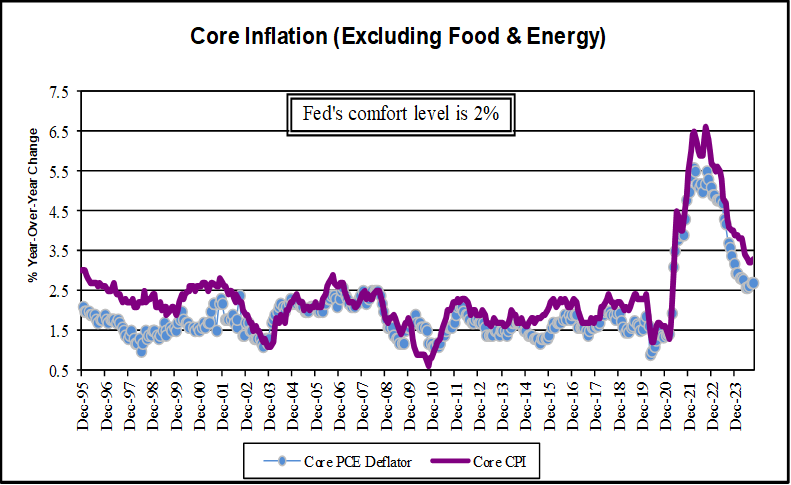

So far, tariffs have had a minimal impact on price increases. Still, it may be premature to try to observe meaningful inflationary pressure from the fluid tariff policy. Price pressures for consumer goods are expected to heat up over the coming months as business draws down existing inventory stockpiles and higher input prices start to squeeze profit margins. Both the Institute for Supply Management (ISM) and the Purchasing Managers Indexes (PMIs) have been trending higher, indicating rising price pressures in the manufacturing and the service sectors. The Federal Reserve’s Beige Book noted that their contacts expect prices and costs to rise at a faster pace moving forward and are looking to pass the costs of tariffs onto their customers.

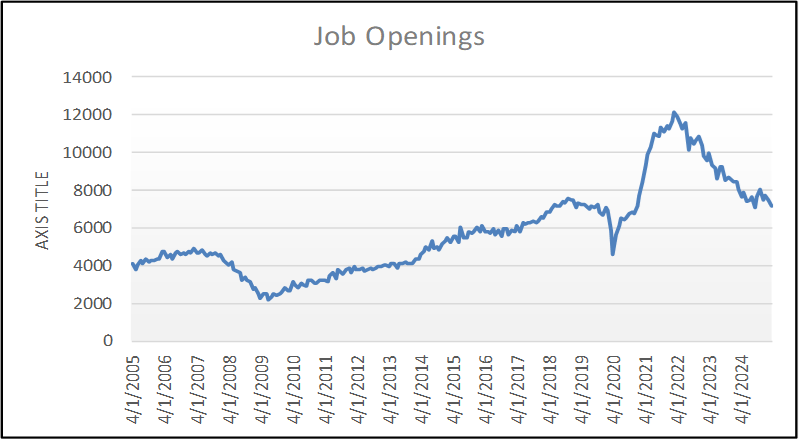

The latest employment report produced some signs of caution. While non-farm payrolls increased more than consensus, the previous two months had significant downward revisions. In the household survey, both civilian employment and the size of the labor force plummeted, and the labor force participation rate ticked down. Additionally, the latest Job Openings and Labor Turnover Survey (JOLTS) showed job openings edged higher, but remain on a downward trend while initial and continuing claims for unemployment benefits have started trending higher. The labor market is starting to struggle as businesses are warning that constantly shifting trade policies are interfering with their ability to plan, leading to hiring freezes. Protecting profit margins in the face of higher input prices and weaker demand may soon increase layoffs to cut costs.

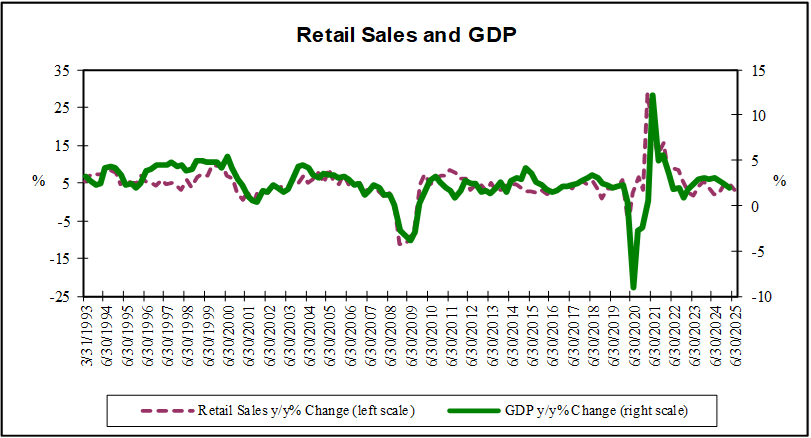

The prospect of a higher unemployment rate and rising inflation pressures are a bad combination for consumers, the primary driver of economic activity. The big question is whether tariff-induced uncertainty, job security concerns and exhaustion of covid-era excess savings will cause household spending to freeze up. Tariff related inflation is expected to negatively impact real income growth. Signs of a deceleration in retail sales and anecdotal evidence in the Federal Reserve’s Beige Book indicate that consumers are tempering their spending, which could signal slower economic growth ahead.

Full Fusion

Full Fusion