January 31, 2026

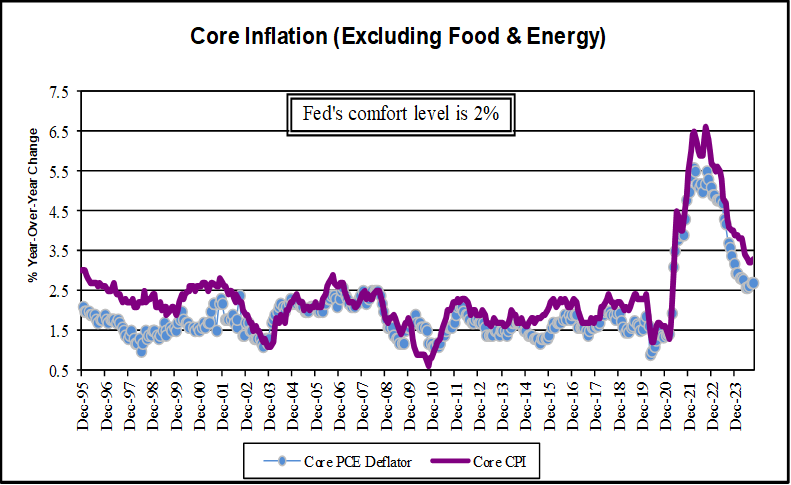

As widely expected, the Federal Open Market Committee (FOMC) held rates steady at its January 27-28 meeting. The full employment mandate remains in the driver’s seat of rate policy, but the central bank sees the risks of its dual mandate (maximum employment and price stability) now in better balance. This comes after the Fed eased rates a total of 75 basis points at three consecutive meetings in the latter part of 2025 and as recent inflation reports have been relatively benign, yet still reflecting levels materially above the Fed’s 2.0% inflation target. The vote to hold rates steady was not unanimous as two officials dissented in favor of cutting rates by 25 basis points. On balance, most of the Fed officials see rates in the vicinity of neutral – a level what neither stimulates or restricts economic activity.

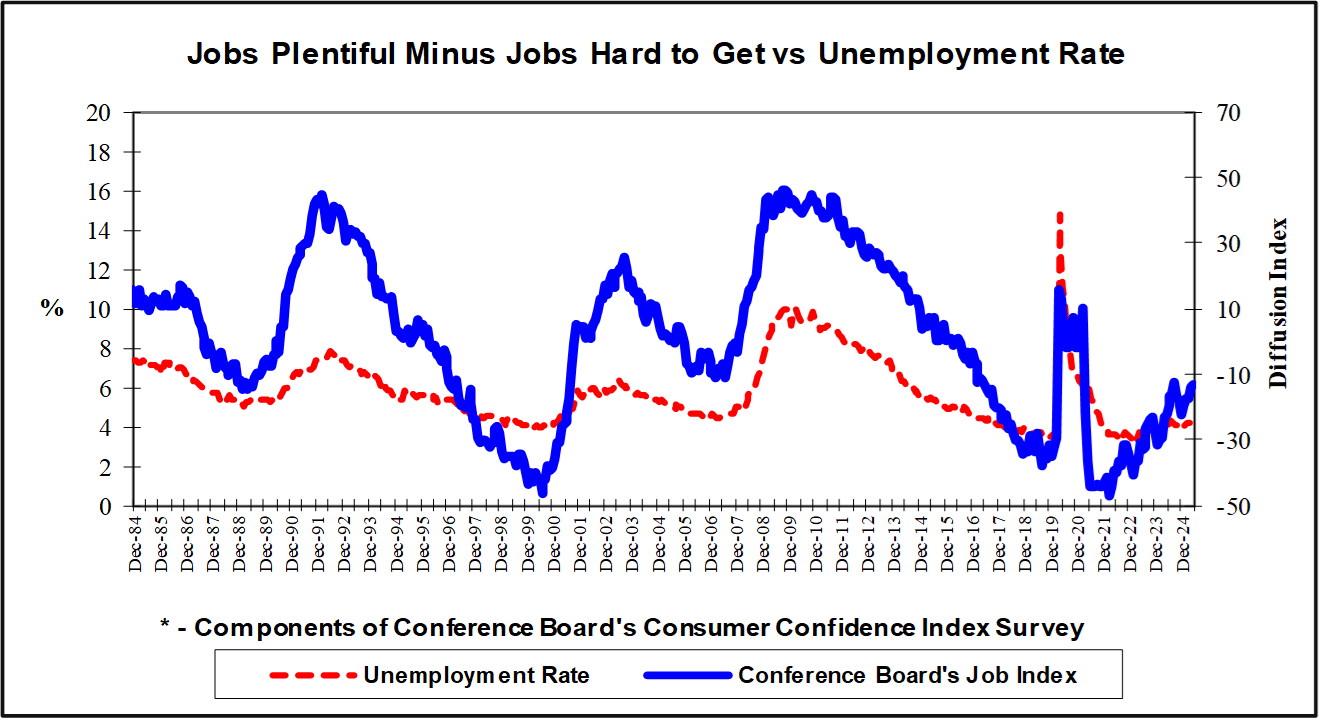

Despite some data fog and distortions resulting from the government shutdown, recent data have generally underscored a resilient U.S. economy. The anecdotal evidence from the latest edition of the Federal Reserve Beige Book offered a more upbeat picture of the economy than the past few reports. It summarized that both the labor market and inflation as broadly stable with increased economic activity following the government shutdown. The economic outlook, however, is not without potential pitfalls. The impact on the economy of a historic winter storm remains to be seen. The Conference Board’s Consumer Confidence Index’s labor market differential continues to show a rising number of respondents reporting that jobs are hard to get and a declining share saying jobs are plentiful. And uncertainty about trade policy and its impact on inflation remains a going concern for business.

Absent a tail-risk event such as another extended government shutdown, adverse Supreme Court rulings and/or a geo-political misstep, there are reasons for optimism about the outlook for economic growth. Stimulus from the One Big Beautiful Bill (OBBA) should provide a tailwind to consumer spending. Also, the lagged effect of the Fed rate cuts should help on the margin. Such an economic boost could tend to skew the Fed toward later and/or fewer rate cuts. If the incoming labor market and inflation data run hotter than expected, the Fed may, in fact, elect to stand pat at the next few meetings and hand the new Chairman of the Federal Reserve an unchanged monetary policy.

Full Fusion

Full Fusion